PROVEN HISTORY

BY THE NUMBERS

Key Facts & Figures as of We Lend inception since 2018*

Note: The facts and figures contained herein are representative of We Lend, LLCs performance. Past performance is not a guarantee of future results. *Data as of 11/08/2022

$478MM

Total Amount Funded

$0

Principle Loss

1,200+

Loans Funded

9.9%

Avg. Borrower Interest Rate

77%

Avg. Leverage at Purchase

220+

Loans Currently Co-Serviced

61%

Of Loans are Repeat Borrowers

Through We Lend, the management team has originated 1,200+ loans, a face value of $478MM+

Loans are primarily made to experienced real estate investors who are in the business of rehabilitating discounted investment properties

Principals invested personal capital into the fund

The Fund is run by experienced real estate investors & lenders who provide keen insight into how to be a creative and responsible lender

The Fund intends to sell selected loans in the secondary market to institutional loan buyers and/or replenish the loans through a credit facility, enabling us to generate a higher yield & mitigate risk

BY THE NUMBERS

Loan Characteristics

Note: The facts and figures contained herein are representative of We Lend, LLCs performance. Past performance is not a guarantee of future results* 2+ Investments

$402K

Avg. Loan Amount

12 Months

Avg. Loan Term

58%

Avg. Loan to After Repair Value

$2.5M

Avg. Borrower’s Net Worth

695

Avg. FICO Score

44

Avg. Age of Borrower

74%

Of Borrowers are Experienced Investors*

INVESTOR SECURITY

Alignment of Interest

Principals invested their capital in The Fund alongside investors

Profit splits occur only after investors receive their preferred return

Security

Safer part of the capital stack

Real estate-backed protection

Senior (1st) lien position

Diversification

Loans are diversified geographically and across several resilient asset classes (residential focus)

Risk is spread across a portfolio of loans

Distribution Frequency

Instant Cash-Flow. The Fund makes monthly distributions

Passive Cash Flow

Delivering attractive returns with first-lien protection and limited liability to LPs

Predictable and consistent returns

Non-Correlated Returns

Our yields are stable because they are not tied to the volatile stock market

Velocity of Capital / Loan Sales

The Fund intends to sell selected loans in the secondary market, enabling us to capture a yield at sale while shifting the default risk, and reinvesting the replenished funds into another loan. The velocity of the fund-sell strategy allows for multiple transactions during the term, creating a higher alpha in the portfolio and mitigating risk

Underwriting

Loans must meet our stringent underwriting guidelines & those of our institutional loan buyers. We place a lot of emphasis on loan-to-value ratios, asset location, borrower experience, borrower FICO, and/or asset class

We must fund institutional-grade loans to ensure the loans can be replenished through a credit facility and/or sold

Risk Adjusted Returns

While generating above-market returns, The Fund reduces exposure to market volatility because of the short-term nature of our loans

Fundamentally, debt investments are safer than an equity investment

WHAT'S NEXT

Velocity of Capital

The Fund intends to sell loans in the secondary market to institutional loan buyers and/or replenish the loans through a credit facility, enabling us to generate a higher yield & mitigate risk

Note: These statements reflect We Lend, LLC’s views and assumptions regarding future events and performance. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are important factors that could cause We Lend, LLC’s actual results to differ materially from those indicated in these statements.

Higher Yield Illustrated:

A loan is funded to a borrower at 12%. The loan is then replenished at ~7.5% or sold at ~10.5%. Once replenished or sold, the capital is re-invested into another loan. While The Fund only retains a ~1.5% to ~4.5% spread, repeating this transaction multiple times a month/year generates a higher yield than 9.5%.

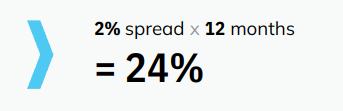

For example:

Let’s say we fund and sell loans once a month and we capture a 2% spread on each transaction.

Risk Mitigation

Selling the loans transfers the default risk to the note buyer.

TYPICAL LOAN CHARACTERISTICS

Loan Type

A non-consumer, interest-only, Business Purpose Loan (BPL) made to real estate operators and investors, and secured through a first lien mortgage against real estate. Also known as: Hard Money Loan

Property Type

- Non-owner occupied residential: 1-4 units

- Multi-Family Properties: 4+ Units

- Mixed-Use Properties: (Typically 50%+ Residential)

Loan Programs

- FixNFlip

- Rental

- Multifamily

- New Construction

Loan to Value

Up to 85% of the acquisition price (compensating circumstances must exist for 90% leverage)

- 82% — Avg. Leverage at Purchase

- 57% — Avg. Leverage against the After Repair Value

Geography

- Nationwide, with a primary focus on the

EAST COAST

Borrower

- Loans are primarily made to experienced real estate investors who are in the business of rehabilitating investment properties

Down Payment

Mandatory 15-35% cash down payment by the borrower

Rates

Interest Rates range from 9-12%

Term

- Short duration: 12 month loans

- Extensions not guaranteed: 3-6 month intervals on case by case basis

Construction Financing

- Option to finance renovation

- If funded, the funds are not disbursed until the work is completed by the borrower. Subject to physical inspection

Strict Underwriting

6-point review: Our underwriting happens in-house. Being former real estate investors enables us to spot a bad loan and/or borrower very quickly

-

Property

- Location - market conditions

- Property condition

- Complete Appraisal Report

- Vetted & insured appraisers

- Conservative valuations

- ARV, AS-IS, and/or rent schedule reports

- Stress-test the appraisal

- Independent comparable search

- Tax Records - how is it taxed, are there any tax liens?

- Department of Building Records

- SOW & Property Inspection Reports

- Transaction History - how has the property traded in the past?

- Confirming the transaction is arms-length

-

Borrower

- Borrower Experience: we look closely at a borrower’s experience. While most of our borrowers are experienced, a loan issued to an inexperienced borrower is compensated by lower leverage.

- Net worth & liquidity has to meet specific thresholds

- Full tri-merge credit report - review the borrower’s tradelines, usage, payment history, etc.

- Conduct a full background search on the borrower

Borrower is required to have “skin in the game” - equity invested at acquisition & construction

-

Credit Facility and/or Loan Buyer Review

- Before funding, we check that loans conform to the underwriting guidelines of our institutional loan buyers and/or our credit facility

-

Title Review & Insurance

- Chain of title

- Encumbrances

- Property Insurance: Builders risk is required. Compliance is verified by our team & a 3rd party

- Bind title insurance with a lender’s policy

-

Construction Financing

- Construction loan is held back. Funds disbursed based on work completed

- Physical inspection with a full construction inspection report

-

Legal Review & Approval

- Our legal team is vetted, insured, and highly experienced working with major lenders and loan buyers

- Strict mortgage documents with Personal Guarantees from borrower

- Reviews title to ensure that the lender's policy is secured

- Location - market conditions

- Property condition

- Complete Appraisal Report

- Vetted & insured appraisers

- Conservative valuations

- ARV, AS-IS, and/or rent schedule reports

- Stress-test the appraisal

- Independent comparable search

- Tax Records - how is it taxed, are there any tax liens?

- Department of Building Records

- SOW & Property Inspection Reports

- Transaction History - how has the property traded in the past?

- Confirming the transaction is arms-length

- Borrower Experience: we look closely at a borrower’s experience. While most of our borrowers are experienced, a loan issued to an inexperienced borrower is compensated by lower leverage.

- Net worth & liquidity has to meet specific thresholds

- Full tri-merge credit report - review the borrower’s tradelines, usage, payment history, etc.

- Conduct a full background search on the borrower

Borrower is required to have “skin in the game” - equity invested at acquisition & construction

- Before funding, we check that loans conform to the underwriting guidelines of our institutional loan buyers and/or our credit facility

- Chain of title

- Encumbrances

- Property Insurance: Builders risk is required. Compliance is verified by our team & a 3rd party

- Bind title insurance with a lender’s policy

- Construction loan is held back. Funds disbursed based on work completed

- Physical inspection with a full construction inspection report

- Our legal team is vetted, insured, and highly experienced working with major lenders and loan buyers

- Strict mortgage documents with Personal Guarantees from borrower

- Reviews title to ensure that the lender's policy is secured

TYPICAL LOAN FUNDING PROCESS

Loan Origination

Borrower completes application with supporting documents

Processing

Processing dept collects supporting documents (i.e. PFS, SREO, SOW), pulls credit, conducts background & OFAC search, & orders appraisal

Underwriting

Underwriting dept reviews all documents, background searches, credit reports, appraisal, & validate property value

Credit Facility / Loan Buyer Review

If the loan is to be replenished through a credit facility or sold to a loan buyer, then the loan is discussed with that party for a second review and soft approval

Legal Review

Legal dept reviews title, property insurance, entity & other legal documents. Prepares loan documents and ensures compliance

Closing/Funding

Closing is scheduled, and the loan is funded

Loan Replenished or Sold

The loan is typically replenished through a credit facility and/or sold to a loan buyer

WHAT PRECAUTIONS IS THE FUND IMPLEMENTING TO REDUCE OUR EXPOSURE TO MARKET VOLATILITY?

Tightened Lending Criteria and Underwriting

Reduced our leverages, effectively requiring borrowers to have more skin in the game

Stress Test Cash Flows

Cash Flows: we analyze the property's current or potential cash flows to ensure that it will be sufficient to cover our mortgage and qualify for a refinance

Increased Our Credit Standards

Currently, 85% of our borrowers are institutional grade with high FICO scores, experienced, and HNW - we want to keep it that way

Stress Test Appraisal

Market Adversity: we stress test the property’s appraisal to ensure that the loans we make are conservative enough to be secured against value fluctuations

WHY DO OUR BORROWERS NOT UTILIZE TRADITIONAL BANK FINANCING?

Speed

We fund loans in as few as 3 days. Borrowers use speed to their advantage when negotiating with their seller

Asset Condition

Traditional banks are unwilling to finance distressed properties

Red Tape

Banks have complex routines and procedures which make it difficult for the borrower to qualify

Competitiveness

Borrowers use a private lender as an advantage against mortgage contingent buyers

Reliability

Traditional banks lack the experience & understanding of the real estate investment space

Guidance

The Fund is run by experienced investors who can guide and consult the borrower through their investment process

WHY INVEST WITH US?

We Are Aligned

GPs are invested alongside their investors

GPs are not earning profits from the fund until the preferred return is paid to our investors

Loan Sales + Yield Enhancement + Risk Mitigator

Selling loans enables the fund to capture a higher yield while transferring the risk and reinvesting the replenished funds into another loan

Diversification

Loans are diversified geographically and across several resilient asset classes

Risk is spread across a portfolio of loans

Underwriting and Deal Flow

Loans must meet stringent underwriting guidelines. We do not outsource our underwriting

Principal Protection

$0 principal loss

Real estate-backed protection

Senior (1st) lien position

Safer part of the capital stack

Transparency

The Fund has a 3rd party fund administrator and loan servicer

Experienced Fund Managers

The Management team has originated 1,200+ loans, a face value of $478MM+ (& currently co-servicing 220+ loans)

While the team originated 1,200+ Loans, we’ve denied 3,000+ Loan requests—we’ve seen a lot

The Mgmt team were real estate investors, specifically in the FixNFlip space, which provides keen insight into how to be a creative & responsible lender

Sign up for our newsletter

DISCLOSURE

This presentation for We Lend, LLC and any appendices or exhibits (the "Presentation") have been prepared by We Lend, LLC for information purposes only. This Presentation is confidential and for its intended audience only. Recipients of this Presentation may not reproduce, redistribute or pass on, in whole or in part, in writing or orally or in any other way or form, this Presentation or any of the information set out herein. This presentation does not constitute an offer to sell or a solicitation of an offer to purchase limited partnership interests in any security.

Any prospective investor is advised to carefully review all of the private placement memoranda, operating agreement, and subscription documents ("Investor Documents") and to consult their legal, financial, and tax advisors prior to considering any investment in We Lend, LLC. The materials contained in this Presentation contain a summary and overview of We Lend, LLC as currently contemplated by We Lend, LLC in order to obtain initial feedback from potential investors. We Lend, LLC may change some terms prior to the finalization of the Investor Documents. This presentation does not purport to be complete and is superseded in its entirety by the information contained in the Investor Documents. Past performance is not indicative of future returns or results. Individual investment performance, examples provided, and/or case studies are not indicative of the overall returns of We Lend, LLC.

In addition, there can be no guarantee of deal flow in the future. Some of the statements in this Presentation, including those using words such as "targets," "believes," "expects,'' "intends,'' "estimates,'' "projects,'' "predicts,'' "anticipates,'' "plans,'' "pro forma,'' and "seeks" and other comparable or similar terms are forward-looking statements. Forward-looking statements are not statements of historical fact and reflect We Lend, LLC’s views and assumptions as of the date of the Presentation regarding future events and performance. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are important factors that could cause We Lend, LLC’s actual results to differ materially from those indicated in these statements. We Lend, LLC’s confidential private placement memorandum. We Lend, LLC believes that these factors include, but are not limited to, those described in the "Risk Factors" section of the PPM.

An Investment In We Lend, LLC involves Risk, And Numerous Factors Could Cause The Actual Results, Performance, Or Achievements Of We Lend, LLC To Be Materially Different From Any Future Results, Performance, Or Achievements That May Be Expressed Or Implied By Statements And Information In This Presentation. Actual Results May Vary Materially From Those Described In This Presentation, Should One Or More Of These Risks Or Uncertainties Materialize, Or Should Underlying Assumptions Prove Incorrect.